This offer is valid until 30th June 2023, so hurry and place your Deposits!

Opening a Deposit is pretty easy. The documents you would require to confirm your:

*If you are a Non-national you will be required to provide a reference letter from your foreign Bank*

Your payment will be accepted in the form of:

Any money you set aside in a Fixed Deposit, at Development Finance, of up to TT$125,000 is fully covered by deposit insurance from the Deposit Insurance Corporation of Trinidad and Tobago

Interest can be received monthly, quarterly, semiannually, yearly or at maturity.

You can call us at 625-0007 ext. 128, 125, 116, 146 or email us at fixeddeposit@dflbusiness.com or

info@dflbusiness.com.

1

This TT dollar fixed deposit will give the client the opportunity to receive the equivalent value of the TTD interest owed in US dollars calculated at the prevailing market rate on the date it is due to be paid.

2

This product will be offered in TT dollars ONLY and the minimum deposit size will be TTD250,000.

3

All rates will be quoted on a per annum basis with interest compounded for deposits greater than one (1) year.

4

Interest on this deposit will be paid yearly or at maturity.

5

This product is covered by the Deposit Insurance Corporation of Trinidad and Tobago.

6

There are NO management or other fees.

Access to US dollars interest is paid in USD.

Security, as deposits are covered by the Deposit Insurance Corporation up to specified limits.

This product is recommended for High Net Worth Individuals, Retirees, Fund Managers, Business Owners, Pension Funds & Insurance Companies.

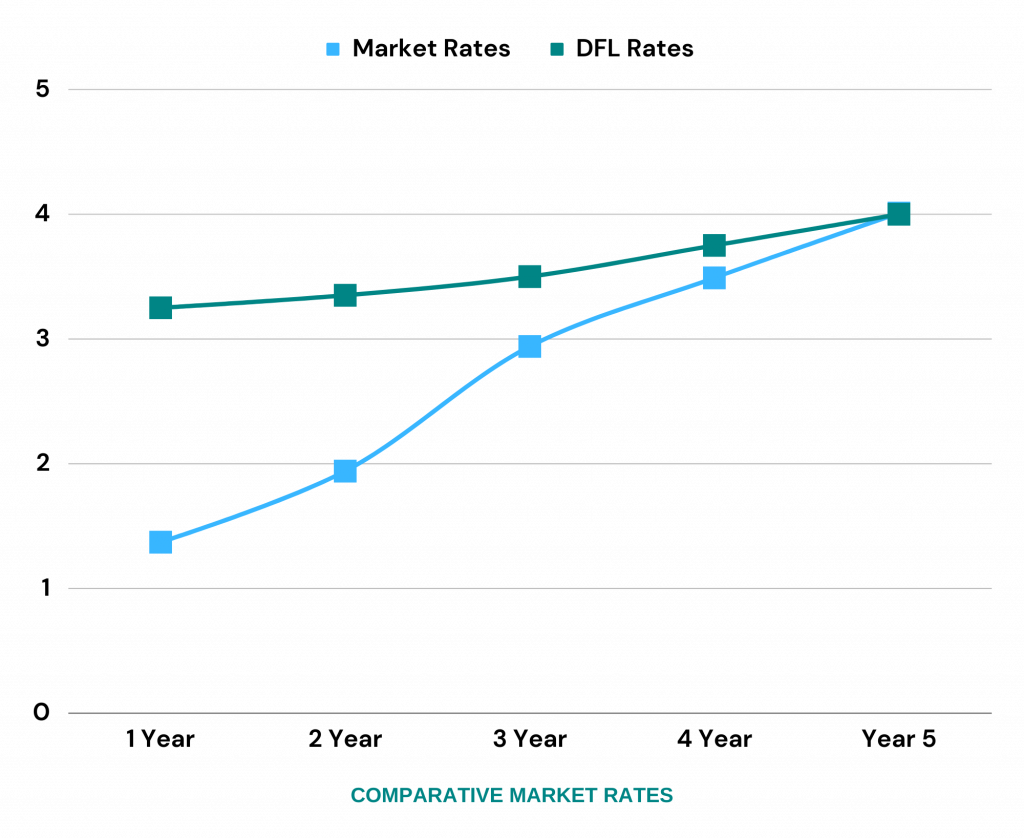

Competitive Interest Rates

The following interest rates are indicative

We're here to help

You can call us at 625-0007 ext. 146, 148, 131, 130 or email us at fixeddeposit@dflbusiness.com or info@dflbusiness.com.

We're here to help

You can call us at 625-0007 ext. 146, 148, 131, 130 or email us at fixeddeposit@dflbusiness.com or info@dflbusiness.com.