Fresh Start Juices: Growth in Motion in Trinidad & Tobago’s Beverage Industry

Fresh Start Juices: Growth in Motion in Trinidad & Tobago’s Beverage Industry

In Trinidad and Tobago’s competitive food and beverage industry, few names resonate quite like Fresh Start Juices. What began in a modest 1,800 square foot space, once a family home tucked away in La Puerta, Diego Martin, has grown into one of the country’s most recognised and respected juice brands.

The last time we told their story, it was one of grit and resilience. A phoenix rising from the ashes. A family that had lost everything, yet found a way to rebuild from scratch using nothing but determination and the willingness to start small. It was a comeback story, but like all great stories, the real test comes after the return.

Nearly a decade later, Fresh Start is no longer focused on survival. It is focused on leading. Today, it is a well-established local brand, stocked across the country, backed by trusted distribution, and led by the next generation. But in a rapidly shifting consumer landscape, where markets are crowded and competition moves quickly, staying visible is no longer enough. The real challenge is staying relevant.

We sat down once again with Marcus Sun Kow, Managing Director, this time joined by his sister Khadine Hosein-Deane, Finance and Administration Director, to talk about what it has taken not just to maintain Fresh Start’s presence, but to evolve. From managing the uncertainty of the pandemic to rethinking how the brand connects with its customers, the conversation offered a behind-the-scenes look at the resilience, intention, and leadership that continue to define the Fresh Start journey.

How Fresh Start Juices Scaled Distribution with HADCO Partnership

A defining moment in Fresh Start’s evolution came in 2019, when the company made a bold and risky decision to dissolve its internal distribution arm and partner with HADCO Distribution.

“That was a huge shift,” Sun Kow said. “We went from three delivery vehicles to tapping into an entire network overnight. Sales reps, merchandisers, food service teams, retail team and brand managers. It allowed us to focus entirely on manufacturing and building a great product, rather than worrying about getting it out there.”

The idea took shape after a conversation Sun Kow had with John Hadad. “At the time, we weren’t looking for investment. But I wanted to understand the model, how manufacturing and distribution could be split successfully,” he said. That seed of a conversation led to months of back and forth, meetings at HADCO, and strategic planning.

It was not without its hiccups. “There was spoilage, customer resistance, operational chaos, but we knew it was the right long-term move,” Sun Kow said. He credits Gary Awai, Chief Executive Officer of Development Finance Limited, as a sounding board during that transitional period. “I called Gary and said, ‘What do I do?’ This wasn’t just about me or my family, it was about what kind of company we wanted to become, and what we were willing to risk to get there.”

Surviving COVID-19: How Fresh Start Adapted and Innovated in Crisis

When the pandemic hit, Fresh Start was already navigating a major shift in its distribution model, but the landscape changed almost overnight. With food service clients accounting for more than half of the company’s revenue, the closure of restaurants and hotels hit hard.

“We didn’t let any staff go, but we had to reduce working hours,” Sun Kow said. “Everyone took cuts, and it was about keeping the lights on.”

At the same time, Fresh Start watched a surge of micro-businesses enter the beverage space. “Suddenly, it felt like everyone was selling juice,” Sun Kow added. “It’s an easy business to start, and during COVID, a lot of people just needed a way to earn.”

Some of those new players even began mimicking Fresh Start’s packaging. “Some copied our label shape, our nutrition panels, everything,” Sun Kow said. “But we held our own.”

To offset some of the losses, the company briefly pivoted to sanitiser production. “It was a short-term opportunity, but we already had the filling lines, the bottles, the water,” he explained. “So we started bottling sanitiser for a company called Biotech. That helped offset some of the lost income.”

Still, the challenges kept mounting. Shipping prices doubled, raw material costs, especially sugar, surged, and international suppliers began demanding payment upfront. “We had been operating on credit,” Hosein-Deane said. “But during COVID, that changed. Suppliers needed full payment upfront, and we had to quickly adapt our cash flow strategies to meet those demands.”

That is where financial relationships made the difference. “Development Finance Limited gave us a moratorium on our loans, and even helped us source US dollars when nobody else could,” she added. “They understood the strain we were under.”

Internally, Hosein-Deane’s careful financial planning was critical to keeping the business grounded. With rising costs and limited flexibility, the team had to constantly weigh priorities, deciding which area needed resources most urgently. The structured cash flow provided by a Manufacturer-Distribution model, along with steady partnerships like PriceSmart, gave the company just enough stability to plan ahead and continue operating with intention.

“We have more appetite for risk now,” Sun Kow said. “You can’t sit on decisions forever. If the opportunity is there, take it, because it might disappear tomorrow.”

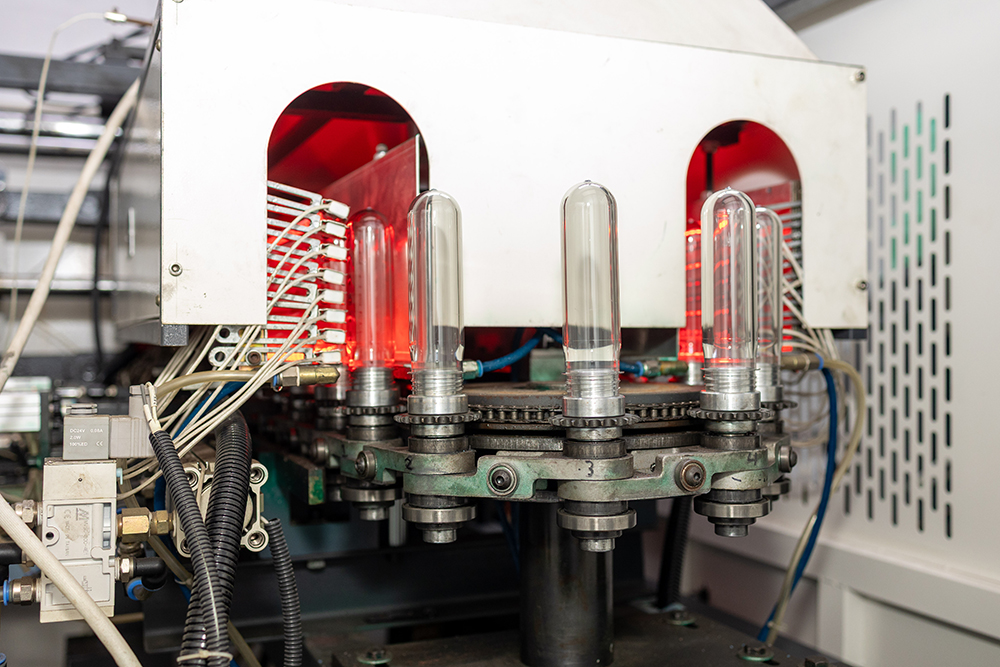

One of those decisions was investing in a bottle-blowing machine that helped reduce long-term packaging costs. “We didn’t have the money when the opportunity came up, but we made it happen. It’s reduced our cost of production and improved our supply chain stability,” Sun Kow explained.

As always, Development Finance Limited played a key role in making that possible. “We’ve never had a situation where we went to Development Finance Limited and the answer was no,” Hosein-Deane said. “They find ways to make things work.”

Staying Competitive: Fresh Start Juices’ Brand and Innovation Strategy

Networking, too, has been an underrated asset. As Sun Kow explained, it has been critical to surround themselves with industry peers, vendors, and even competitors, staying informed, finding technical partners, and securing the talent needed to evolve. Sometimes that meant bringing in external experts to operate new machinery or engaging global contacts to troubleshoot equipment installations.

Fresh Start also has several forward-facing projects in motion. Among the most promising is their rollout of branded dispensers to supplement their strength in the food service industry by providing restaurants a mechanism to help increase their profitability, consistency and availability of the Fresh Start products via an innovative route to market. In short Fresh Start supplies the juice concentrate and equipment, while the restaurant serves the beverages, creating a win-win model for both sides. The team is currently in discussions with various chains to begin the roll out.

On the product side, their Barddies Cocktail Mixers are already in select bars and recently entered Massy Stores distribution. Developed entirely in-house, the Bardies line is a testament to Fresh Start’s growing R&D capacity and evolving understanding of consumer trends. “There’s huge export potential in this space,” Sun Kow said, referencing their interest in import substitution and offering a local alternative to foreign cocktail mixers.

The Bardies line also enjoyed a major breakthrough at the Trade & Investment Convention (TIC) 2025, where its official launch drew overwhelming public engagement. Fresh Start’s booth was awarded Best Booth of the exhibition, attracting massive crowds and sparking conversations across the trade floor. For the team, the recognition went beyond sales; it validated Barddies’ appeal with both consumers and industry leaders, positioning the mixers as one of the most exciting new entrants in Trinidad and Tobago’s beverage market.

Building on that momentum, the company recently received a grant to onboard a research assistant focused on product development. This investment in research and technical capacity reflects a shift in how Fresh Start views growth. It is not just about what is selling now, but about what is next and how they can be first to market.

Together, these moves point to a brand that is not just surviving in a saturated space, but positioning itself to lead it.

How Development Finance Limited Became Fresh Start’s Superpower Partner

Meanwhile, some of the ambitions featured in Fresh Start’s earlier story did not unfold as envisioned. The UK export partnership with Wanis, for instance, ultimately did not materialise, and plans for a snack line were paused due to shifting priorities and funding realities. But what followed was not failure. It was a recalibration. A more focused, deliberate approach emerged, where innovation was no longer reactive but supported by the infrastructure and partnerships to carry it forward.

Through every twist in the road, one ally remained a steady force.

Development Finance Limited was more than a funder. They were guardians. Part watchtower, part sounding board, and always a step ahead. Hosein-Deane recalls the care that went beyond transactions. “They weren’t waiting for us to raise the alarm,” she said. “They called. They noticed shifts in our accounts, followed up on projects, and genuinely wanted to know how we were managing.”

Whether it was tapping someone in their network or calling just to ask, “What do you need?” The team at Development Finance Limited made themselves available. Not just in moments of success, but especially in seasons of uncertainty. They made Fresh Start feel protected, backed, and believed in.

From sales representatives to senior executives, there was always a voice at the other end of the line. Always a willingness to find a solution. That commitment turned a financial relationship into a real partnership. The kind that fuels transformation, not just transactions.

In a fast-paced industry, that kind of care is its own kind of superpower.

Looking Ahead

Like the juice they press from the island’s sun-ripened fruit, Fresh Start’s story has always been one of extracting strength from strain. Once forged in the ashes of crisis, the company has learned not only to rebuild, but to reimagine.

If their early journey was about rising, today’s chapter is about soaring, not just above the fray, but toward a future they are shaping on their own terms.

CBTT’s Market Conduct Guideline | Privacy Policy